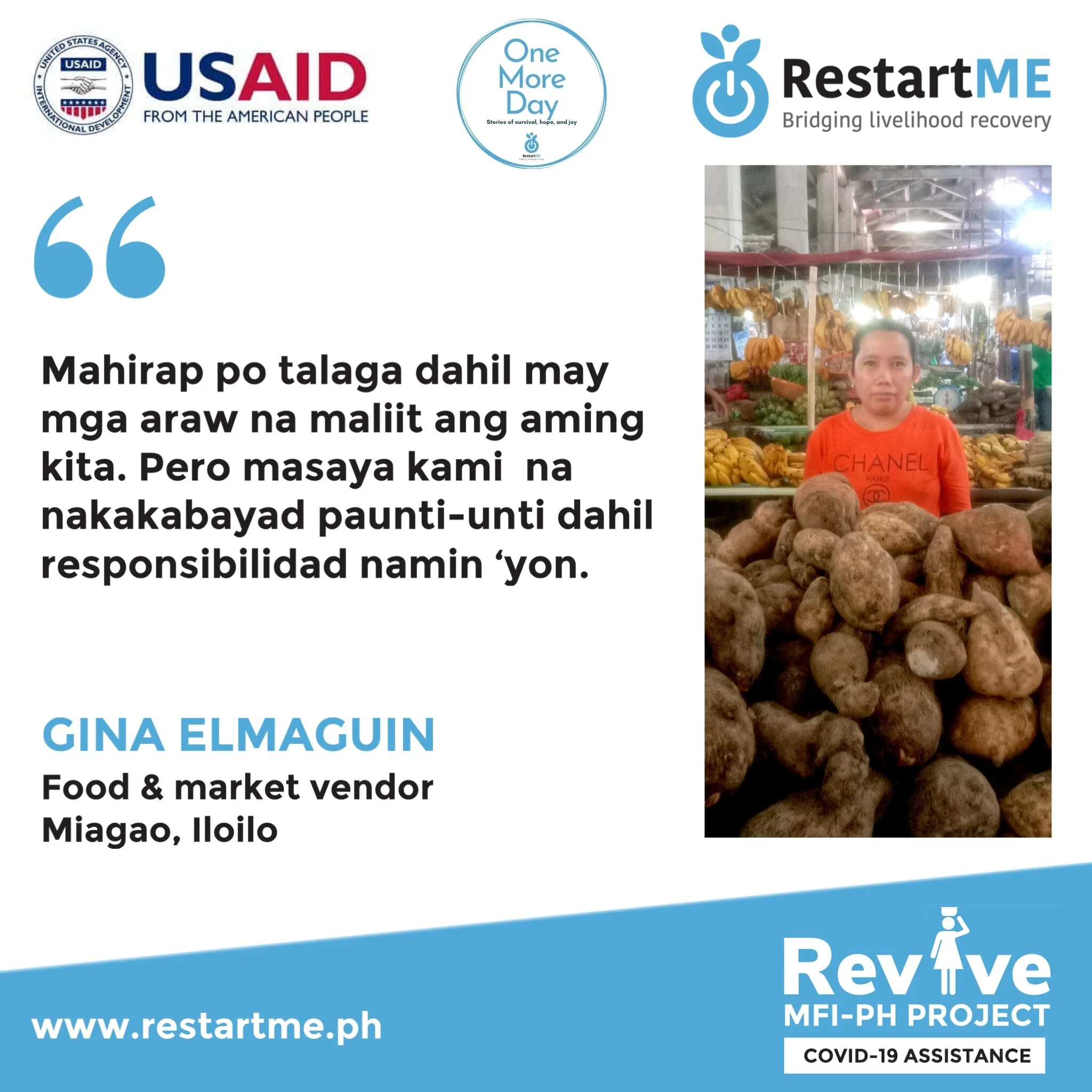

One More Day with Gina

Market and Food Vendor.

Gina Elmaguin is a fruit and vegetable market vendor from Brgy. Kirayan Sur, Miagao, Iloilo. As a first-time borrow of the Taytay sa Kauswagan, Inc., she received a Php20,000 loan through the Revive MFI-Ph project funded by USAID and implemented by RestartME Foundation and Chemonics International.

Gina is the breadwinner for her nine-member household which includes her grandchildren. Her husband used to be a construction worker but lost his job when the COVID-19 pandemic hit. Before the series of lockdowns were imposed by local and national government, Gina was earning up to Php3,000 daily which was sufficient for her family’s modest lifestyle and daily needs. Her house was made of nipa and bamboo, and they get their water from a water pump outside their house.

However, her sales from the public market plummeted when the pandemic happened, and she thought of devising a new way to earn. She got a small space beside the church in their barangay, and started to sell ready-to-eat street foods like banana cue and barbeques, which sold faster than her products at the market. This new microenterprise helped her family get through the pandemic.

With the new Php20,000 loan from TSKI, Gina was able to have more capital to purchase raw materials to sustain both her microbusinesses. Nevertheless, she admits to encountering challenges in terms of low sales that sometimes makes it difficult to repay her loan.

Gina said: “Mahirap po talaga dahil may mga araw na maliit ang aming kita. Pero masaya kami na nakakabayad paunti-unti dahil responsibilidad naming ‘yon.”

(It is difficult because on some days our sales are really low. But we feel grateful that we are still able to repay our loan even in increments, because that is our responsibility).

Gina’s story is a reminder of the challenges that many microenterprises face amid the economic impacts of the COVID-19 pandemic. While many big businesses are starting to recover, recovery for smaller business may take time. It also shows the commitment of microentrepreneurs to repay their loans to microfinance institutions that extend them financial services at a time when they need it most during a crisis.